Bumpy Start for the Healthcare Marketplace

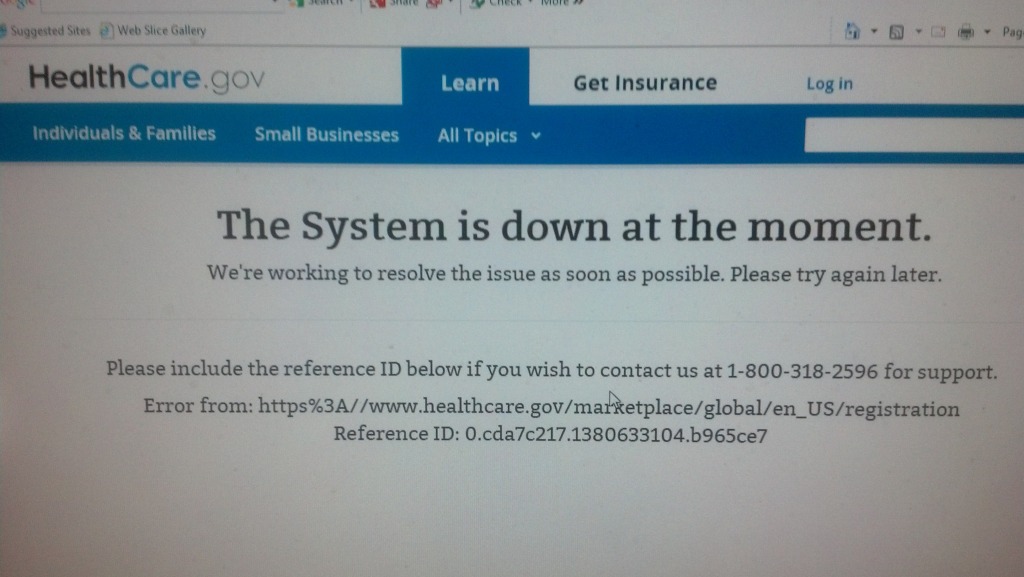

The highly anticipated “marketplace” went live online this morning and if you tried to immediately shop for healthcare coverage, odds are you didn’t get very far. The website www.healthcare.gov experienced frequent crashes after going online at about 8:00am and those who were able to load the home page were sent to a virtual waiting room.

Healthcare advocates had predicted the possibility of difficulties on day one as potentially millions of Americans tried to access the website to solve their health insurance woes. They urge patience and remind you that the enrollment period continues for 6 months, through March 31st, for 2014 coverage. After that, the enrollment period for each year will run from October 1st through December 7th of the previous year.

Those seeking coverage under the Affordable Care Act should also be careful to use the proper website, which is www.healthcare.gov. Another website, healthcare.com, was also offering side-by-side policy comparisons as of Tuesday morning, but officials say in order to receive tax credits for your insurance purchase you must go through the .gov website.

If you are seeking coverage under the Affordable Care Act, advocates say you should be very careful to compare the plans that will be available to you.