Posts

Closing in on the Fiscal Cliff

/in News /by PAMattersThe federal government is less than a month away from driving straight off the “fiscal cliff,” but U.S. Senator Pat Toomey (R-PA) believes there’s still time to avoid it. “The great dangers of the fiscal cliff are the massive tax increases that are scheduled to go into effect on January 1st,” Toomey told reporters on a recent conference call. “If that were to happen, it would very likely throw the economy into a recession and cost us hundreds of thousands – if not over a million – jobs.”

Toomey is in the thick of Senate discussions, and has been meeting privately with Democratic Senators in an effort to broaden support for a plan he first put forward in last year’s Super Committee. It would call for lower income tax rates for all – with limitations on deductions, loopholes and write-offs that will raise hundreds of billions of dollars in net revenue over time.

Inaction will lead to rate hikes on income taxes, estate taxes, dividends and capital gains. The White House says a median-income Pennsylvania family of four (earning $80,400) could see its income taxes rise by $2,200. A 2-percentage point payroll tax cut would also expire.

But that’s just the tax hike side of the equation. The fiscal cliff also includes $1.2-trillion dollars in federal spending cuts over the next ten years.

Professor David Passmore with Penn State’s Institute for Research in Training and Development crunched the numbers to see how sequestration alone would affect the Keystone State. “Pennsylvania’s share would be in the order of 35 – 40,000 jobs; the loss of about $6-billion in total economic output; about $3.5-billion in industry sales; and about $2.1-billion in after tax personal income,” he explains to Radio PA. The report was first published in Pennsylvania Business Central.

Like Toomey, Passmore believes the “fiscal cliff” is the recipe for another tough recession.

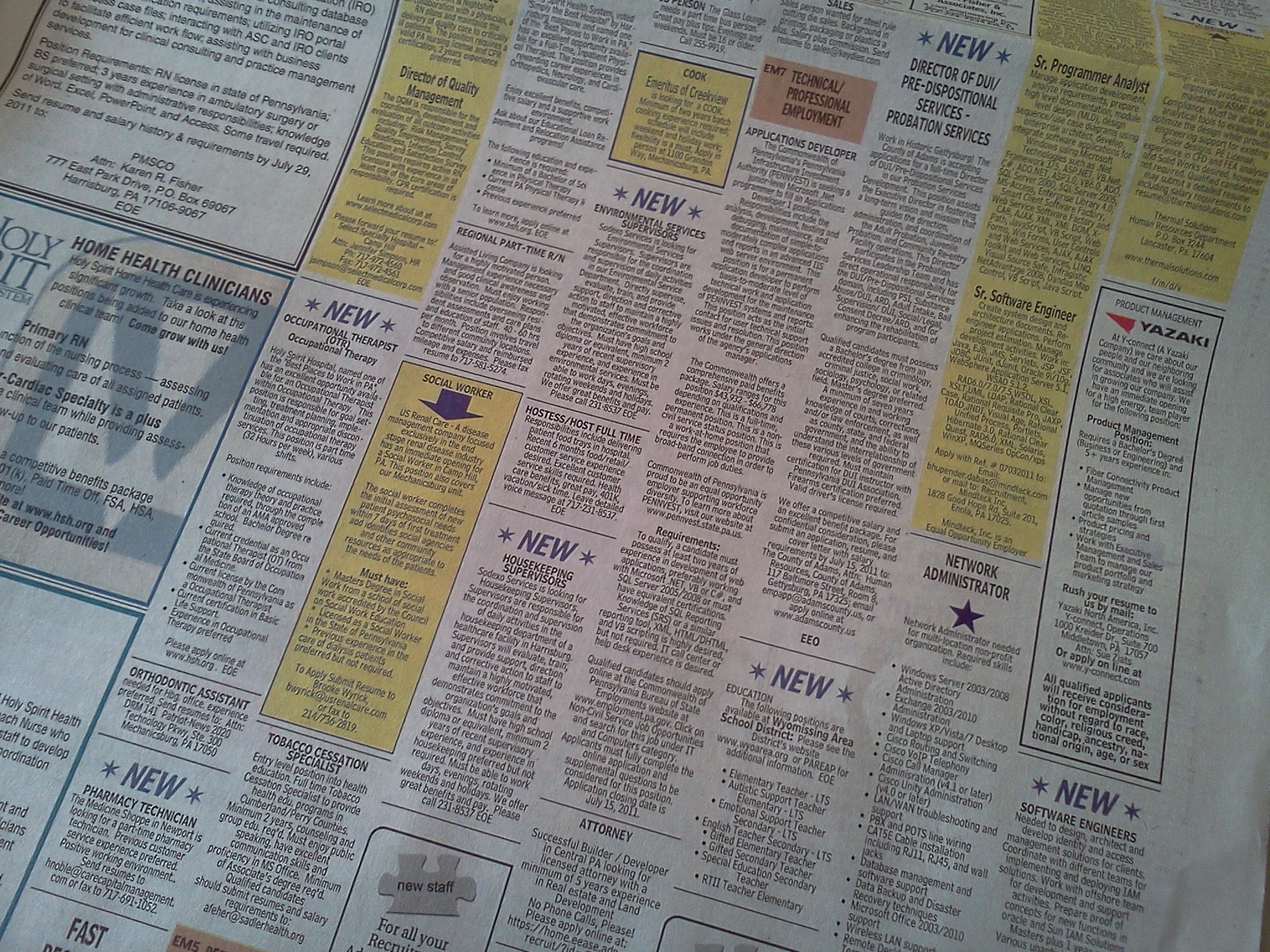

Jobs Bill Unveiled on Lawmakers’ First Day Back to Session

/in News /by PAMattersThe new bill would incentivize qualified companies to relocate to Pennsylvania by allowing them to keep up to 95% of the Personal Income Tax they withhold on behalf of their employees. It’s dubbed Promoting Employment across Pennsylvania (or PEP!).

“Employers that bring a certain number of jobs, pay good wages and provide quality benefits would be eligible for this incentive,” says state Rep. Kerry Benninghoff (R-Centre), the bill’s prime sponsor. “Keep in mind, right now, we don’t have these jobs or the revenue these employers would be paying through state and local taxes. In other words we have nothing to lose and everything to gain.”

At a Monday morning news conference, PEP! supporters indicated that 20-other states already have a similar program in place. But several lawmakers on the House Finance Committee voiced their concerns at a public hearing that soon followed.

Pennsylvania’s existing businesses were at the crux of those concerns. “I want to see jobs created in Pennsylvania, but I don’t want to see it done at the expense of those of us who have struggled through…” says Rep. Scott Boyd (R-Lancaster).

Minority Chair Phyllis Mundy (D-Luzerne) brought up the so-called Delaware Loophole. “If we would close that and do some other things, perhaps we could reduce taxes on all the businesses on Pennsylvania; both the existing and luring new businesses here.”

But Benninghoff, the Finance Committee Chairman, doesn’t believe that HB 2626 would pit existing businesses against those it would lure into the state. “Remember, we all benefit if a new company moves into our area,” Benninghoff says, as he points out that by giving up one source of revenue, the state would be gaining many more.

PEP! awaits action in Benninghoff’s committee.

Governor Tom Corbett on a recent poll on taxes and privatizing state liquor stores

/in Ask the Governor, Media, News, Video /by PAMattersBuffett Rule Appears to be Big Election Year Tax Battle

/in News /by PAMattersPresident Barack Obama is pushing it; his likely Republican challenger rejects it; and the US Senate can neither advance nor kill it. At issue is the so-called Buffett Rule, which would ensure that Americans whose incomes exceed $1-million dollars pay a minimum tax rate of 30%.

“This is a gimmick, it’s a political gimmick,” US Senator Pat Toomey (R-PA) said on the Senate floor this week. Toomey believes the ongoing debate is an effort to engage in class warfare and distract from the Obama administration’s economic mismanagement.

But Keystone Research Center labor economist Mark Price says you can’t pay down the nation’s massive budget deficit without raising additional revenue. “Very wealthy households are able to take advantage of tax loopholes to pay less of their income in taxes than many middle class Pennsylvania families,” he says.

In their Buffett Rule analysis, Price and the Pennsylvania Budget and Policy Center examined seven of the richest zip codes in the nation. What they uncovered was an effective tax rate of 17.2%. By comparison, they found that 99% of the Commonwealth’s taxpayers live in zip codes where the average tax rate is higher.

Pennsylvania is home to roughly 10,000 millionaires, but Price believes the Buffett Rule would only impact between 1,000 and 4,000 of them.

The Buffett Rule’s namesake – billionaire investor Warren Buffet – has just revealed that he’s been diagnosed with an early stage of prostate cancer. In a letter to Berkshire Hathaway shareholders, Buffett indicated that it is not life threatening or debilitating.

Governor Tom Corbett on Pennsylvania’s Economy

/in Ask the Governor, Media, News, Video /by PAMattersModernization Plans Dominate PLCB Appropriations Hearing

/in News /by PAMattersTalk of liquor store privatization was brushed aside at Thursday’s Senate Appropriations Committee with the Liquor Control Board. Instead, the focus was on modernization.

The governor’s proposed budget calls for an $80-million dollar transfer from the Liquor Control Board to the General Fund next year. LCB CEO Joe Conti tells lawmakers that number is right on target, but they could generate even more revenues if only they were allowed to modernize. “It’s clear that we think we could add $70-million dollars to our bottom line,” Conti explained during an extended Q&A with the committee.

One of the high-profile reforms he seeks is flexible pricing. “We would just like to price the way that all other retailers price their product, with a mix of pricing,” Conti explained. “And we are not able to do that now.” He later stressed that prices would still be the same across the commonwealth, but the LCB would have greater discretion in how they are set.

The retail price we pay on every bottle at state-run liquor stores includes: the wholesale price, the 18% state liquor tax, a 30% markup, a handling fee and federal alcohol taxes. The flexible pricing allowed in SB 1287 would allow the LCB to vary its 30% across-the-board markup, based on the product, and likely nix the handling fee.

That legislation currently awaits action in the Senate Law & Justice Committee. Meanwhile, legislation to privatize PA’s liquor stores is awaiting action in the House. The Liquor Control Board is scheduled to appear for its House Appropriations Hearing on February 27th.

Governor Tom Corbett on his upcoming 2012 budget address

/in Ask the Governor, Media, News, Video /by PAMattersWelcome to PAMatters.com, a new source for news and commentary from Pennsylvania’s capital. In addition to video, audio and pictures from the stories and events that affect YOU, you’ll also get some behind-the-scenes analysis via blogs from our award-winning staff of journalists.