Posts

Busy June on Tap in Harrisburg

/in News /by PAMattersThe House and Senate are due back in session on June 3rd. From there only 15-or so session days separate lawmakers form the state budget deadline. But Governor Tom Corbett views every day as a working day, and there are plenty of policy issues he’d like to see addressed alongside a third consecutive on-time budget.

“We need to focus on [liquor privatization], we need to focus on pensions, we need to focus on transportation, we need to focus on the budget,” Corbett said on the May edition of Ask the Governor. “There has been work done behind the scenes. I believe we can get this done.”

Most capitol observers, however, would classify passage of two of the three big policy issues as a major victory for the Corbett administration.

Senate Republican Leader Dominic Pileggi (R-Delaware) identifies transportation as the issue most likely to be completed before lawmakers’ summer break. “We have very, very strong bipartisan interest in transportation infrastructure funding,” he says. “I think that can certainly be done.”

Trailing the pack of policy issues, Pileggi says, is pension reform. “We have not even seen committee action on that plan to date and the bills have just been introduced… that is an incredibly complex and technically difficult task.”

Following this week’s hearing on liquor privatization, Senate Law & Justice Committee Chairman Charles McIlhinney (R-Bucks) made it clear that he won’t start drafting a bill until after all three public hearings have been completed. He does not view it as an issue that must be finalized this budget season. The House version of a privatization bill (HB 790) is viewed as a non-starter in the Senate.

Governor Tom Corbett on the Big Four; Transportation, Liquor, Pensions and the Budget

/in Ask the Governor, Media, News, Video /by PAMattersPension Reform Plan Becomes Legislation

/in News /by PAMattersBills that are about to be introduced in the House and Senate will reflect the comprehensive pension reform plan that Governor Tom Corbett outlined back in February. “Should we be successful, this will be the most comprehensive pension reform package in the United States of America,” explains Senator Mike Brubaker (R-Lancaster), who will sponsor the Senate bill. As Chairman of the Senate Finance Committee, Brubaker also vows to schedule a public hearing on the issue.

Without pension reform, supporters say the only other options are deep budget cuts or sharp tax increases. “We have to convince both sides of the aisle in the legislature that this isn’t a partisan issue, this is a future of Pennsylvania issue,” Governor Tom Corbett said while flanked by supporters at a lunchtime news conference in the capitol building.

Pointing to the current $47-billion dollar unfunded liability across the state’s two big public pension plans, Corbett says each Pennsylvania household would have to write a check for $9,500 just to cover that cost. He adds that without reform the state’s pension obligations will consume more than 60-cents of every new revenue dollar in the years ahead. The state’s pension obligation is growing from $1.1-billion dollars last year, to $4.3-billion by 2016.

So what would the Corbett plan do? Starting in 2015, new hires would be enrolled in a 401(k)-style defined contribution retirement plan, instead of the traditional defined benefit pension system that exists today. Current employees would remain in the defined benefit plan, but their future benefits would be reduced to help save the state $12-billion dollars over the next 30-years.

Doing this, the Corbett administration says, will allow the state to save $175-million dollars in the coming fiscal year. PA’s 500-school districts are scheduled to share in nearly $140-million in savings.

But opponents say there are hidden costs that outweigh the potential savings. “You would speed up the process at which all of the dollars that are currently there would be paid out,” state Treasurer Rob McCord says of the move to phase out the existing pension plans, “and the professional investment managers would have to move it all towards fixed income, highly liquid assets that have very low returns.”

The public sector unions continue to lead the opposition, pointing to a 2010 pension reform law they say is just now starting to yield results. “We have more folks going into it, money going into the system for the unfunded liability, and our returns are doing better,” AFSCME Council 13 executive director David Fillman said on an afternoon conference call with reporters. He’s referring to Act 120 of 2010, which reduced new hires’ benefits while requiring them to pay more into the system. Fillman says 11,000 workers have been hires since the law took effect.

Even if state lawmakers get past the wrangling over the dollars and cents of comprehensive public pension reform, the question of constitutionality will undoubtedly wind up before the state Supreme Court. And that may be what’s giving Harrisburg the most pause with just eight weeks to go before the new fiscal year.

Revenue Report Predicts Big Budget Hole

/in News /by PAMattersThe $230-million dollar year-end surplus that was projected when Governor Tom Corbett delivered his February budget address isn’t likely to materialize in the final two months of the fiscal year. “At the end of the day we think we’ll be back at the original estimate from last June,” explains Independent Fiscal Office director Matthew Knittel.

Pennsylvania’s General Fund collections may be running $67-million above last June’s estimates, as of today, but they’re actually falling short of February’s revised expectations.

Compounding the problem, the IFO is now projecting 1.2% growth in state revenues in the new fiscal year. It may only be a slight downgrade from the 1.3% projection used to crunch the numbers in the governor’s budget plan, but it adds up to another $278-million dollar shortfall.

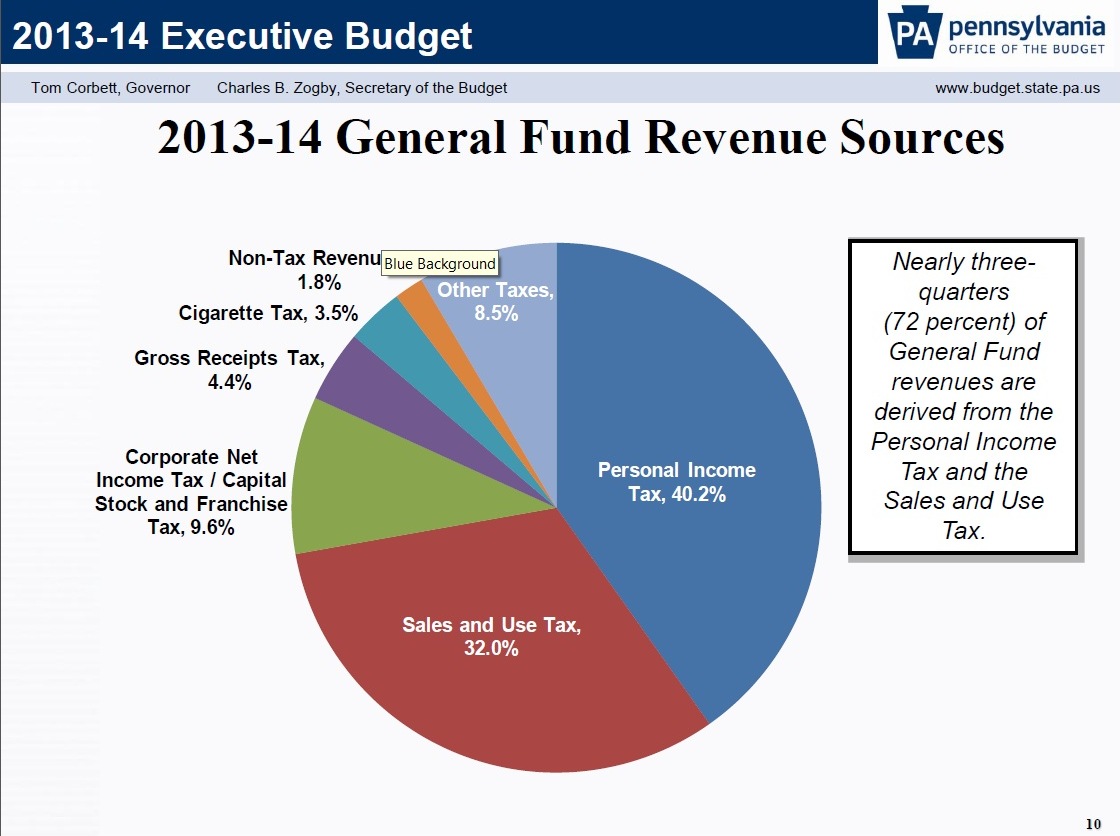

Combined, it’s a more than $500-million dollar hole in next year’s state budget. What’s changed since February? Knittel says sales and use tax collections are lagging.

“What we think is happening is that consumers are taking a hit,” Knittel explains. “We had some federal tax increases to start the year – the payroll tax cut expiration, some tax increases on high income individuals, and we think that’s restraining spending currently. But when we move into fall and winter, the consumers will have absorbed that hit and we think the spending will return.”

Meanwhile, the state budget season just got more difficult as state policymakers will have to find the cuts and/or revenues to fill a potential half-billion dollar hole.

Panelists: PA’s Homelessness Problem is Solvable

/in News /by PAMattersPolicy experts and service providers are updating state lawmakers on the issues surrounding homelessness, and the data show that more than 34,000 Pennsylvanians obtained homeless services in 2011. That number doesn’t include people who may be living in cars or in tent encampments who have not sought out the services that exist.

Housing Alliance of Pennsylvania executive director Liz Hersh says it’s not a choice; it’s a failure of our system. “We’re spending money on the most expensive solutions – like emergency shelter – when in fact if we were smarter about how we spent money, and focused on prevention, it would be less traumatic for people, less disruptive and cheaper for all of us and for taxpayers.”

Hersh and others testifying before the House Democratic Policy Committee support preventive programs that help to keep people in their homes or obtain affordable rental housing. “If we invest a little, we actually end up saving a lot,” she says, noting that such programs cost less than half as much as emergency homeless services.

The Homeless Assistance line item in the state budget, which is used for preventive services, was cut from $20.5-million to $18.5-million for the current fiscal year. The governor has proposed level funding for next year.

Gov’s Tax Reform Plan under the Microscope

/in News /by PAMattersThe Corbett administration believes the price of doing business in Pennsylvania is too high. So they plan to finally eliminate the capital stock & franchise tax as of January, and want to gradually reduce the state’s corporate net income tax from 9.99% – 6.99% over the next 12-years.

“Governor Corbett’s broad-based tax reform proposal sets the stage for robust economic growth by developing a competitive business tax structure, as well as improving the process of collecting taxes and simplifying the tax code,” Revenue Secretary Dan Meuser told the House Finance Committee on Thursday.

But minority chair Phyllis Mundy (D-Luzerne) told Meuser there’s one glaring omission: the plan does not close corporate tax loopholes, like the Delaware Loophole. Mundy is the prime sponsor of legislation that would do that via combined reporting, but Meuser suggests it would do more harm than good.

Mundy also points out that the corporate tax breaks proffered by the administration would result in an $800-million dollar annual loss to state tax revenues when fully implemented. “And I’m not at all sure – I wish I could believe – that these tax cuts for large corporations would result in enough job creation to overcome that deficit,” she says.

Meuser, however, says the economic growth spurred by the governor’s tax plan will mean $1-billion dollars in new state tax revenue by 2030. “That comes from personal income growth, that comes from employment and that comes from sales tax revenues that are derived from those who are now working that weren’t before.”

The state has the 2nd highest corporate net income tax in the nation and is one of only a few states that tax both business income and assets, in that the capital stock & franchise tax is a levy against a business’s assets regardless of whether it made money or not.

The Corbett Tax Plan would also raise the cap on net operating loss deductions, allow for start-up business deductions, repeal the corporate loans tax and eliminate what Meuser describes as “nuisance taxes.”

But everything is subject to the approval of the General Assembly, and as members of the Finance Committee exited Thursday’s hearing they surely noticed the protesters in the capitol rotunda who rallied against the Corbett plan and argued that corporate tax breaks do not create jobs.

Governor Tom Corbett on Expansion of Medicaid Eligibility

/in Ask the Governor, Media, News, Video /by PAMattersGovernor Tom Corbett on Recent Criticism and the Polls

/in Ask the Governor, Media, News, Video /by PAMattersRadio PA Roundtable 03.08.13

/in Audio, Media, News, Radio PA Roundtable /by PAMattersOn this week’s Radio PA Roundtable, Matt Paul takes us inside the final budget hearing of the three week cycle. Lawmakers and Governor Tom Corbett now have three and a half months to work out a compromise before the June 30th state budget deadline.

We’ll also get an update on the first confirmed cases of CWD in hunter-killed deer in Pennsylvania, and flesh out the Department of Corrections 2013 Recidivism Report.

Radio PA Roundtable is a 30-minute program featuring in-depth reporting on the top news stories of the week.

Click the audio player below to hear the full broadcast:

[audio:https://s3.amazonaws.com/witfaudio/radiopa/Roundtable03-08-13.mp3]Welcome to PAMatters.com, a new source for news and commentary from Pennsylvania’s capital. In addition to video, audio and pictures from the stories and events that affect YOU, you’ll also get some behind-the-scenes analysis via blogs from our award-winning staff of journalists.