Posts

Revenue Report Predicts Big Budget Hole

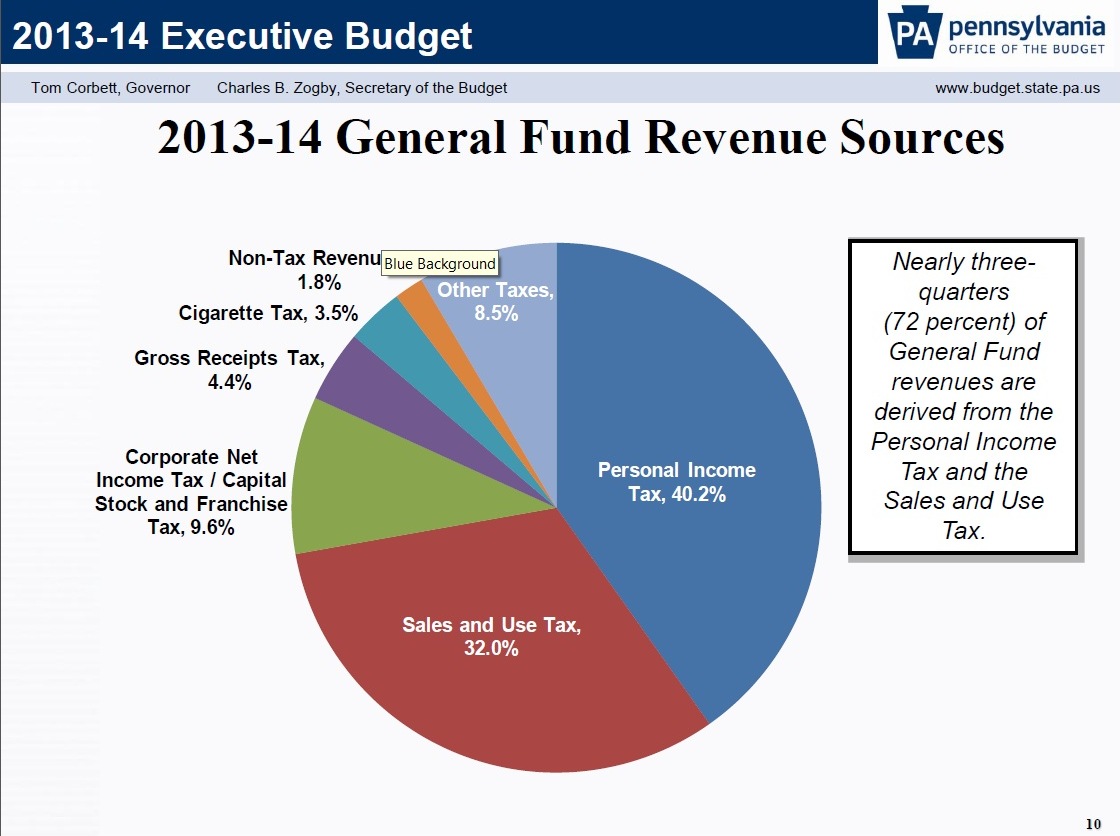

/in News /by PAMattersThe $230-million dollar year-end surplus that was projected when Governor Tom Corbett delivered his February budget address isn’t likely to materialize in the final two months of the fiscal year. “At the end of the day we think we’ll be back at the original estimate from last June,” explains Independent Fiscal Office director Matthew Knittel.

Pennsylvania’s General Fund collections may be running $67-million above last June’s estimates, as of today, but they’re actually falling short of February’s revised expectations.

Compounding the problem, the IFO is now projecting 1.2% growth in state revenues in the new fiscal year. It may only be a slight downgrade from the 1.3% projection used to crunch the numbers in the governor’s budget plan, but it adds up to another $278-million dollar shortfall.

Combined, it’s a more than $500-million dollar hole in next year’s state budget. What’s changed since February? Knittel says sales and use tax collections are lagging.

“What we think is happening is that consumers are taking a hit,” Knittel explains. “We had some federal tax increases to start the year – the payroll tax cut expiration, some tax increases on high income individuals, and we think that’s restraining spending currently. But when we move into fall and winter, the consumers will have absorbed that hit and we think the spending will return.”

Meanwhile, the state budget season just got more difficult as state policymakers will have to find the cuts and/or revenues to fill a potential half-billion dollar hole.

“Property Tax Independence Act” Updated for New Session

/in News /by PAMattersThe push to eliminate school property taxes in Pennsylvania isn’t going away; supporters say it’s growing stronger. A bipartisan group of state lawmakers gathered in the Capitol Media Center, Tuesday, to unveil the latest version of the Property Tax Independence Act, and state Rep. Jim Cox (R-Berks) is leading the charge for the second consecutive session.

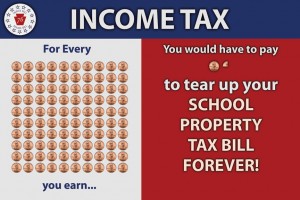

“This is what it would take to fully replace school property taxes once and for all,” Cox said while clenching a penny between his thumb and index finger. “This is what stands between Pennsylvanians and the ability to completely eliminate school property taxes, and the ability to own their own homes.”

What’s being proposed is actually a dollar-for-dollar replacement of school property taxes. Here’s what it would take:

A one penny increase in the state sales tax (from 6 to 7% in most counties)

A broadening of the sales tax base

A 1.27-percentage point increase in the state personal income tax (from 3.07 – 4.34%)

“How can you let a penny stand in the way of getting the job done?” – Rep. Cox at Tuesday’s news conference.

Rep. Cox believes this shift in taxation will spread out the school funding burden much more fairly, and result in more disposable income in Pennsylvanians’ pockets.

The biggest difference from last year’s plan is in the personal income tax rate. The earlier version would have only raised it to 4.01%, but it was adjusted after an analysis from the Independent Fiscal Office determined last year’s version of the bill would have resulted in a revenue shortfall.

“We now have an independent verification that the numbers simply do add up. This is revenue neutral legislation. We have the facts to prove it. A dollar-for-dollar match to fund our public schools,” explains Sen. David Argall (R-Schuylkill) who’s sponsoring a companion bill in the Senate.

Adjusting for the IFO analysis has taken one of the key complaints off-the-table: fear that it would raise insufficient revenues. However, past concerns have also focused on the free pass the tax shift would give large businesses and whether sales & income taxes are as stable as property tax revenues.

The House and Senate bills are expected to be referred to their respective Finance Committees.

Online Shoppers Should Pay Attention to Sales Tax

/in News /by PAMatters“Cyber Monday” sales increased nearly 30% over last year, according to early reports from IBM Benchmark. Many online retailers are now collecting and remitting Pennsylvania’s 6% statewide sales tax, but the Department of Revenue is still advising shoppers to save their receipts.

“The first thing to do is to check and see if sales tax was charged on the online purchase. If it was charged, then the consumer doesn’t need to do anything,” explains Department of Revenue spokeswoman Elizabeth Brassell.

But if you don’t see sales tax on your purchase records, Brassell says it’s the responsibility of the consumer to report the “use tax” to the state when computing their 2012 tax returns.

It appears that many more people are taking notice of the sales & use tax rules, as the state collected $3.8-million dollars in self-reported use tax last year via a new, simplified process on the PA-40 tax form.

Radio PA Roundtable 08.31.12

/in Audio, Media, News, Radio PA Roundtable /by PAMattersOn this week’s Radio PA Roundtable, Brad Christman and Matt Paul remind you to pay that state sales tax when purchasing items online, as the state focuses on stricter enforcement of the existing law; also on this Labor Day weekend, you’ll hear the results of the “State of Working Pennsylvania” report; and we’ll give you a sneak peek into the new Joe Paterno biography that hit the book stores this week.

Radio PA Roundtable is a 30-minute program featuring in-depth reporting on the top news stories of the week.

Click the audio player below to hear the full broadcast:

[audio:https://s3.amazonaws.com/witfaudio/radiopa/Roundtable08-31-12.mp3]Online Retailers to Begin Collecting PA Sales Tax

/in News /by PAMattersPennsylvanians’ online shopping sprees won’t be tax-free for much longer. Starting September 1st, online retailers with nexus – or a physical presence – in the state must collect and remit sales taxes. In an interview with Radio PA, state Revenue Secretary Dan Meuser said they are simply enforcing the existing law. “The governor has pledged no new taxes. The governor is not going to raise taxes. However, we are going to administer and enforce the laws fairly on all taxpayers.”

Mueser says the enforcement effort is more about tax fairness than revenue generation, but he does estimate that it will result in an additional $55-million dollars in sales tax collections per year.

The strictly enforced system is intended to be fairer to Pennsylvania’s brick & mortar retailers. “Those companies on Main Street tend to do most of the hiring and employment and living in our communities, so it’s simply not fair for us not to enforce the laws appropriately,” Meuser says.

Businesses were notified of the enforcement effort last December. The original February compliance deadline was pushed back until September, and Meuser says there will be no more extensions.

While he declined to discuss specific companies, Meuser does expect former e-commerce companies, both large and small, to be collecting and remitting sales taxes as of September 1st.

Governor Tom Corbett on a recent poll on taxes and privatizing state liquor stores

/in Ask the Governor, Media, News, Video /by PAMattersPA Clarifies Sales Tax Rules, Eyes Online Retailers

/in News /by PAMattersBusinesses are pouring over a new Tax Bulletin from the Pennsylvania Department of Revenue, which clarifies existing sales tax nexus law. The law requires businesses with a physical presence in Pennsylvania to collect and remit sales taxes on items sold online, by phone or by catalog. “Thousands of retailers and businesses that employ people throughout the state, and collect and remit 6% sales tax – 7% in Allegheny [County] and 8% in Philadelphia – felt that they were being treated unfairly,” explains Revenue Secretary Dan Meuser.

The bulletin informs remote sellers, which have nexus in Pennsylvania, that they have until February to become licensed to collect sales tax. Failure to do so could result in audits, liens or other enforcement measures.

It could have a broad application across online-only retailers that have not been collecting and remitting state sales taxes, according to Dan Hayward with the Pennsylvania Alliance for Main Street Fairness. The Pennsylvania Retailers’ Association joins Hayward in calling it a great first step toward equity and fairness. “Pennsylvania’s retailers, and the more than 600,000 jobs they have created, deserve fairness and a level playing field with their Internet competition,” says PRA President & CEO Brian Rider.

Testifying before the House Finance Committee in May, the Department of Revenue estimated that PA is missing out on $350-million dollars a year because online retailers aren’t collecting sales taxes.

But just because state sales tax isn’t collected on many online purchases, it doesn’t mean taxes aren’t due. Beginning in January the state will provide a line, on Pennsylvania personal income tax returns, which allows individuals to self-report their use tax. Use tax rates are identical to the sales tax; they’re due when consumers make taxable purchases for which no sales tax is collected.

Pennsylvania Business Group Supports Bill Aimed At On Line Retailers

/in News /by PAMattersSmall business owners from Pennsylvania are lending their support to a bill being introduced by an Arkansas Republican and California Democrat in the U. S. House of Representatives to address sales tax collections by on line retailers. The Marketplace Equality Act would empower states to require online companies that do not have a physical presence in the state to collect and remit state sales tax for transactions with state residents.

Daniel Hayward of the Pennsylvania Alliance for Main Street Fairness says small business owners just want a level playing field. He says many people don’t realize when they buy on Amazon.com or other on line retailers they still are supposed to send that sales tax back to the state at the end of the year.

Hayward says this would allow the matter to become a “state’s rights” issue. He says all they’re asking is that those large on line only retailers collect the sales tax at point of sale and remit it to the state, just like brick and mortar retailers do all across Pennsylvania.

He believes Pennsylvania’s Congressional delegation wants to take action to level the playing field for brick and mortar retailers in competing with the big on line retailers.

Hayward says they did a study through Carnegie Mellon University, and it found Pennsylvania may be missing out in collecting between 250 and 390 million dollars in sales tax per year through sales made by on line retailers to state residents.

The bill would include an exemption for small E-tailers to ensure that start ups and small sellers will not face the same compliance requirements that are more easily adopted by large on line retailers.

The bill is being proposed by Steve Womack (R-AR) and Jackie Speier (D-CA) . In a press release, Representative Womack says the intent of the legislation is to close a long-standing loophole that puts America’s brick and mortar businesses at a competitive disadvantage. Representative Speier stated it’s time to close the gaping loophole that is costing businesses sales to large internet retailers and depriving states, local communities and schools of sales tax revenues that they should be receiving.

Similar legislation has been introduced in the past. Several states have their own laws, but they apply to businesses with a physical presence in the state.

Welcome to PAMatters.com, a new source for news and commentary from Pennsylvania’s capital. In addition to video, audio and pictures from the stories and events that affect YOU, you’ll also get some behind-the-scenes analysis via blogs from our award-winning staff of journalists.