Posts

Governor Tom Wolf on when the Budget Stalemate Becomes a Crisis

/in Ask the Governor, Media, News, Video /by PAMattersLt. Governor Jim Cawley on Governor Tom Corbett

/in Ask the Governor, Media, News, Video /by PAMattersGovernor Tom Corbett Answers Listener Email

/1 Comment/in Ask the Governor, Media, News, Video /by PAMattersHouse Committee Sends Republican Budget to Floor

/in News /by PAMattersFloor debate is expected to start next week after a budget plan cleared the state House Appropriations on Monday. The 28.3 billion dollar House Republican spending plan passed solely along party lines on a 21 to 14 vote.

The House Republican plan spends less than Governor Tom Corbett’s budget proposed in February but more than the current year’s budget.

Chairman Bill Adolph (R-Delaware) emphasized that he was not presenting it as the final budget. He says negotiations are ongoing regarding a number of significant issues.

Representative Adolph says the plan represents a starting point for the budget negotiations and outlines priorities important to members of the house and does so without raising taxes.

But minority chair Joe Markosek (D-Allegheny) called additional spending for basic education paltry and too little, too late. He says the proposed budget does not address Medicaid expansion while allowing the Governor’s business tax policies to eat away at the money available to fund core government services.

“Property Tax Independence Act” Updated for New Session

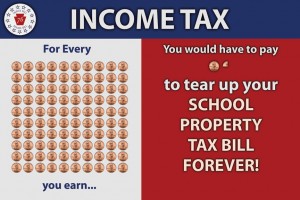

/in News /by PAMattersThe push to eliminate school property taxes in Pennsylvania isn’t going away; supporters say it’s growing stronger. A bipartisan group of state lawmakers gathered in the Capitol Media Center, Tuesday, to unveil the latest version of the Property Tax Independence Act, and state Rep. Jim Cox (R-Berks) is leading the charge for the second consecutive session.

“This is what it would take to fully replace school property taxes once and for all,” Cox said while clenching a penny between his thumb and index finger. “This is what stands between Pennsylvanians and the ability to completely eliminate school property taxes, and the ability to own their own homes.”

What’s being proposed is actually a dollar-for-dollar replacement of school property taxes. Here’s what it would take:

A one penny increase in the state sales tax (from 6 to 7% in most counties)

A broadening of the sales tax base

A 1.27-percentage point increase in the state personal income tax (from 3.07 – 4.34%)

“How can you let a penny stand in the way of getting the job done?” – Rep. Cox at Tuesday’s news conference.

Rep. Cox believes this shift in taxation will spread out the school funding burden much more fairly, and result in more disposable income in Pennsylvanians’ pockets.

The biggest difference from last year’s plan is in the personal income tax rate. The earlier version would have only raised it to 4.01%, but it was adjusted after an analysis from the Independent Fiscal Office determined last year’s version of the bill would have resulted in a revenue shortfall.

“We now have an independent verification that the numbers simply do add up. This is revenue neutral legislation. We have the facts to prove it. A dollar-for-dollar match to fund our public schools,” explains Sen. David Argall (R-Schuylkill) who’s sponsoring a companion bill in the Senate.

Adjusting for the IFO analysis has taken one of the key complaints off-the-table: fear that it would raise insufficient revenues. However, past concerns have also focused on the free pass the tax shift would give large businesses and whether sales & income taxes are as stable as property tax revenues.

The House and Senate bills are expected to be referred to their respective Finance Committees.

House Majority Proposes Charter, Cyber Charter Funding Changes

/in News /by PAMattersThe cyber school funding formula is at the center of the latest charter school debate in Harrisburg. House Republicans unveiled a package of bills on Friday, which would allow school districts to make four additional deductions when calculating payments to cyber charter schools.

“Our children are being treated as second-class citizens in the education world, and it’s not fair,” says PA Families for Public Cyber Schools Executive Director Jenny Bradmon. On average, she says charter schools are already receiving just 70% of what it costs a school district to educate a child.

But state Rep. Mike Reese (R-Westmoreland/Fayette) says it’s not about picking winners and losers. “This is about making sure that there’s equitable funding for both brick-and-mortar public schools and our cyber schools in Pennsylvania,” he tells Radio PA.

“I believe cyber schools play a very important role in our education system, no doubt about that, but I think we have a responsibility to the taxpayers of Pennsylvania to make sure that their tax dollars are being spent wisely.”

Among other things, Reese’s legislation would allow school districts to deduct 50% of the cost of extra-curricular activities and 100% of the cost of things like student health, food and library services. These are costs borne by a district’s taxpayers, but services that are not necessarily offered by the cyber schools.

There are parts of the House GOP package that charter school advocates do support. For instance, one provision would call for the state to fund charters directly in order to ensure timely payments. Another would allow for longer charter terms, which would allow the schools to obtain better financing for their own capital projects.

But Pennsylvania Coalition of Public Charter Schools Executive Director Bob Fayfich says the so-called cyber funding reforms are arbitrary. “They’re based not on what the cost is for a high-quality cyber education… but rather an arbitrary percentage of costs associated with the expenses of the district.”

House Republicans call their bills a “starting point” for discussions with all interested parties.

The Pennsylvania School Boards Association (PSBA) and Pennsylvania State Education Association (PSEA) have each released statements referring to the Republican package as a positive step toward meaningful charter school reform.

More than 105,000 Pennsylvania students are currently enrolled in 157-charter schools and 16-cyber charter schools. The statewide average for non-special education charter school payments is just over $9,400 per student.

First Democrat Enters Gov’s Race

/in News /by PAMattersThe field of Democrats seeking to unseat Governor Tom Corbett may get crowded by 2014, but for today there’s only one. John Hanger, a former Department of Environmental Protection (DEP) Secretary under Governor Ed Rendell, is touring the state to kick off his gubernatorial bid.

Hanger wants to reverse education budget cuts and tax natural gas drillers. “In September and October, for the first time in years, Pennsylvania’s unemployment rate went above the national rate,” Hanger pointed out during a stop at the state capitol. “That’s an extraordinary thing because of the gas boom and the gas opportunity that we have here.”

The Republican Party of Pennsylvania has already fired back, issuing a statement that reads: “…The Corbett record of responsibility and success is a stark contrast from the broken, bloated and unsustainable state government that tax-and-spend politicians like Ed Rendell and John Hanger helped to create…”

October’s statewide unemployment rate stood at 8.1%. While it’s above the national rate, data from the Department of Labor & Industry also show that Pennsylvania has added 105,700 private sector jobs since Corbett took office.

A November Quinnipiac Poll finds that PA voters are somewhat divided on the job Governor Corbett is doing: 40% approve, 38% disapprove.

State Rep. Puts School Districts on Notice

/in News /by PAMattersDepartment of Education data show Pennsylvania school districts had a combined $3.2-billion dollars in reserve funds as of the end of last school year. Taxpayers deserve an explanation, according to State Rep. Mike Vereb (R-Montgomery). “The people on these school boards that are holding on to these pots of money need to come clean with the taxpayers that they are about to jump into their pockets and raid one more time,” Vereb said at a capitol news conference on Monday.

Vereb rattled off a list of the districts with the most cash in the bank. He says it’s ludicrous for school districts to propose property tax hikes and point their fingers at Harrisburg while holding onto vast reserves.

But much of the money represents school districts’ attempts to help smooth out the looming pension spikes that are legislatively mandated, according Dave Davare, director of research services at the Pennsylvania School Boards Association (PSBA).

Speaking to Radio PA Davare rattled off his own list of school districts that are, in fact, tapping their reserve funds in order to balance FY 2013 budgets. The PSBA advises school districts to use reserve funds as one-time revenue streams for one-time expenses. “When a district uses its fund balance to pay for teachers’ salaries so they don’t have to lay off teachers this year, that just means next year when they don’t have that fund balance, they’re going to have to lay off teachers at that point,” Davare explains.

Rep. Vereb says the rule of thumb is that schools’ reserve funds should be 5 -7% of their operating budgets. He’s looking into possible legislative action.

Welcome to PAMatters.com, a new source for news and commentary from Pennsylvania’s capital. In addition to video, audio and pictures from the stories and events that affect YOU, you’ll also get some behind-the-scenes analysis via blogs from our award-winning staff of journalists.