Posts

Governor Tom Corbett on property taxes in Pennsylvania

/in Ask the Governor, Media, News, Video /by PAMattersGovernor Tom Corbett on using a revenue surplus to ease the budget pain

/in Ask the Governor, Media, News, Video /by PAMattersRevenue Collections End Year Up Almost 3% Over Estimates

/in News /by PAMattersPennsylvania ended the fiscal year in the plus column. Revenues for June were 8.3 percent, or $246.1 million above estimates.

The Pennsylvania Department of Revenue says the numbers were boosted by higher collections for sales, personal income, corporation and inheritance taxes. They offset declines in realty transfer and other general fund taxes, such as cigarettes, malt beverage, liquor and table games.

Sales tax receipts were $72.2 million above estimate in June and 3% or $252.9 million more than anticipated for the fiscal year.

The Personal Income Tax revenue was $115.5 million above estimate for June and 3.1 percent or $311.2 million above estimate for the fiscal year.

Corporation Tax Revenue was $32.3 above estimate for June and $245.4 million or 5.3 percent above estimate for the fiscal year.

Inheritance Taxes brought in $9.2 million more than expected for June, bringing the fiscal year 4.5 percent or $34.3 million ahead of estimates.

However, the Realty Transfer Tax was $1.7 million below estimate for June, lagging by 12.4 percent or 39.4 million below estimates for the fiscal year.

Other General Fund tax revenue brought in $6.9 million less than estimated for June and were off 2 percent for the fiscal year, $30.1 million less than expected.

For the fiscal year 2010-11, General Fund collections exceeded estimates by 2.9 percent or $785.5 million.

Non-tax revenue ended the year 1.1 percent, or $11.2 million, above estimate.

Motor License Fund collections for the year were 8.5 percent, or $197.6 million, above estimate. Those revenues include gas and diesel taxes along with license, fine and revenue fees.

Governor Tom Corbett Not Budging on Surplus Issue

/in News /by PAMattersThrough the first eleven months of the fiscal year, the Department of Revenue reports that collections have outpaced expectations to the tune of $540-million dollars. Many lawmakers are ready to tap into that money to mitigate some of the proposed budget cuts. However, Governor Tom Corbett isn’t ready to use the “S” word… surplus. “I don’t know how you have a surplus when we know that Pennsylvania – because of the recession, because of the number of people who lost jobs – had to borrow money from the federal government, [and] owes the federal government $3.7-billion dollars as we sit here today.”

Governor Corbett’s comments came on Radio PA’s monthly Ask the Governor program, which is featured here in PAMatters.com. Corbett said he’s sticking to the $27.3-billion dollar framework he laid out during his March 8th budget address: “That allows everybody to plan based upon that number, and to make the difficult cuts, and I wish they didn’t have to make those cuts. I don’t want to have to make those cuts, but it’s necessary to get our house in order.”

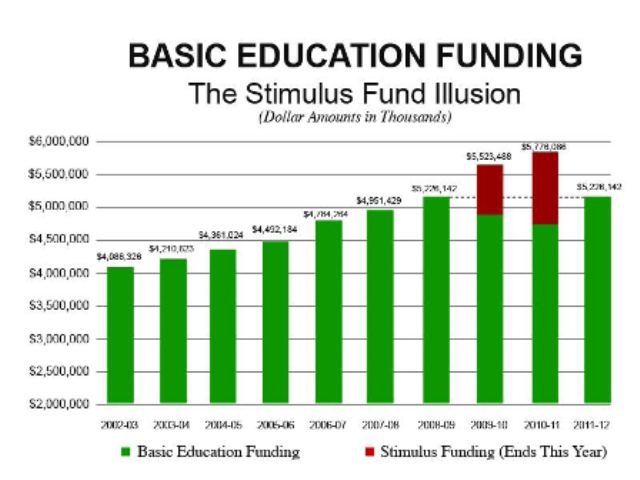

Corbett has come under fire in recent months for the education cuts he’s proposed for next year’s budget. “We didn’t do this lightly, we’re not being hard-hearted about this, but we have a $4.2-billion dollar hole in the budget,” Corbett says, referring to the structural deficit that exists in large part to the expiration of the federal stimulus program. Corbett points out that basic education has been held at pre-stimulus levels (see insert).

House Republicans’ budget bill would restore $100-million dollars to the basic education funding line item, and account for an additional $380-million dollars for higher education. Governor Corbett’s original budget plan would have slashed funding for the State System of Higher Education, and State Related universities, in half. But House Republicans didn’t add to the $27.3-billion dollar bottom line – they instead trimmed an additional $470-million dollars in welfare spending. Asked about those projections, Corbett was skeptical: “Do I believe we’re going to find savings in the Department of [Public] Welfare? Yes. Am I going to find it at the rate, at the number and at the speed that we need to for one fiscal year? I have grave concerns about that. I’m a very cautious person.”

Corbett, House and Senate leaders will flesh out their budget priorities in the weeks ahead, in hopes of meeting the June 30th budget deadline. If successful, it would be the first on-time state budget in eight years.

What Should Lawmakers Do With Unanticipated Revenue?

/1 Comment/in News /by PAMattersAlmost everyone expects an on-time budget, for a change. But there’s no consensus on how to handle state revenues that have come in $540-million dollars above estimate through the first 11-months of the fiscal year. Senate Minority leader Jay Costa (D-Allegheny) says it should be used to mitigate proposed education budget cuts for the new fiscal year, which starts on July 1st. “It’s very hard to defend – given the nature of the reductions in expenditures that are being proposed – that we can squirrel away $600-million dollars,” Costa says, as he predicts the state will end the fiscal year with a $580 – $600-million dollar surplus.

“We will ultimately use about half of the budget surplus, or somewhere in that vicinity, is sort of my prediction in terms of where we are going,” Costa tells us. He adds that it’s still not enough for Senate Democrats’ liking, but that the cuts won’t be as “draconian” as they are now. Earlier in the week, a Senate Republican spokesman told us they will seek to use “some” of the surplus to soften the impact of education and hospital cuts.

House Republicans, however, passed a $27.3-billion dollar budget that would not spend this year’s higher-than-expected revenues. During last month’s budget debates, Appropriations chair Bill Adolph (R-Delaware) stressed that we don’t know if this revenue is sustainable. “Calls for increased spending, based upon a few months of bringing in more money than expected, are irresponsible in our current economic climate.”

That’s long been the stance of the Corbett administration, and it seems they have at least one Democrat on their side. “I think Governor Corbett is right to say that the majority of the surplus needs to be kept in reserve for the unknown,” says Auditor General Jack Wagner, who finished second in the 2010 Democratic gubernatorial primary. Asked about the budget battle at an unrelated news conference, Wagner cautioned that Pennsylvania’s liabilities dwarf any surplus. He cites additional pension obligations, money owed to the Pennsylvania Employee Benefit Trust Fund and a pending labor contract, just to name a few.

The state budget deadline is June 30th. Senate Republican Appropriations chair Jake Corman (R-Centre) recently told us that he expects to have an “action plan” by the end of the week.

State Budget Battle Shifts to Senate Side of the Capitol

/in News /by PAMattersThe budget bill’s next stop is the Senate Appropriations Committee, following this week’s largely party line vote in the State House. Senate Appropriations chair Jake Corman (R-Centre) tells us they’ll spend the next week or so reviewing the legislation, and hope to have an action plan by the first or second week of June. When asked about the $27.3-billion dollar bottom line, Corman said, “We’re certainly not locked into any number. It could go lower, it could go higher.” One of the most contentious parts of this week’s House budget debate was what to do with this year’s revenue, which has so far exceeded expectations to the tune of $500-million dollars.

On the issue of higher education, the House budget bill would fund the 14-State System schools at 85% of the current year’s appropriation. State Related Universities (like Penn State and Pitt) would receive 75% of the current year’s funding. While this compares favorably to the roughly 50% cuts that Governor Tom Corbett proposed in March, Corman says he’d like to do even better and show some parity between the State System and State Related universities. “We’ll review that to see where monies are available… but the House did a pretty good job in showing commitment to higher ed,” Corman says. Senator Corman’s 34th Senatorial District includes State College Borough, the home of Penn State University.

Corman says, overall, the House did a good job crafting a budget. “The Senate will have a different set of priorities I’m sure, and we’ll put our stamp on it. That doesn’t necessarily mean that we disagree with what they did, just that we maybe have different priorities.” The process will result in a Senate version of the budget, from which legislative leaders and the Corbett Administration can negotiate. Like all legislative leaders, Corman is well aware of the June 30th budget deadline. “The people of Pennsylvania have been put through enough over the past eight years,” he says. The budget process is currently running ahead of schedule.

Welcome to PAMatters.com, a new source for news and commentary from Pennsylvania’s capital. In addition to video, audio and pictures from the stories and events that affect YOU, you’ll also get some behind-the-scenes analysis via blogs from our award-winning staff of journalists.